HOW A NEW REAL ESTATE INVESTOR SAVED $36,000 ON THEIR TAX BILL!

CASE STUDY: 2905 Corpus & 310 E 26th St.

After years of success investing in oil and gas, Trey was ready to diversify into real estate—but he wasn’t prepared to keep writing six-figure checks to the IRS. By acquiring two single-family rentals and utilizing 100% bonus depreciation, Trey was able to deduct nearly $100K in his first year and shelter over $36,000 in taxes, all from properties placed in service in early 2025.

Prepared by: SFR Cost Seg

Client: Trey C.

Properties: 2905 Corpus Ave & 310 E 26th St, Texas

Studies Completed: 2025

Building Type: Single-Family Residential Rentals

What is Cost Segregation?

Cost segregation is a tax strategy that allows real estate owners to accelerate depreciation on certain parts of a property—such as flooring, lighting, appliances, and land improvements—by separating them from the building’s structure. Instead of depreciating everything over 27.5 or 39 years, these components can be written off in just 5, 7, or 15 years. This results in significantly larger deductions in the early years of ownership, which can lower your tax bill and free up capital to reinvest.

The Background

Trey is no stranger to investment success. Over the last decade, he built a high-net-worth portfolio through strategic oil and gas mineral investments, generating significant income and becoming accustomed to writing large checks to the IRS.

But after years of collecting royalty payments and watching his tax liabilities grow, Trey knew he needed a smarter way to steward his wealth.

As he began exploring real estate development and acquisition, Trey connected with his longtime friend, an experienced property management and real estate operator in West Texas. He was introduced to a powerful but often overlooked tax strategy: cost segregation.

Though Trey didn’t fully understand the mechanics at first, he trusted his friend's insight and quickly acted. He acquired two rental properties and engaged SFR Cost Seg to deploy the strategy and unlock hidden tax savings.

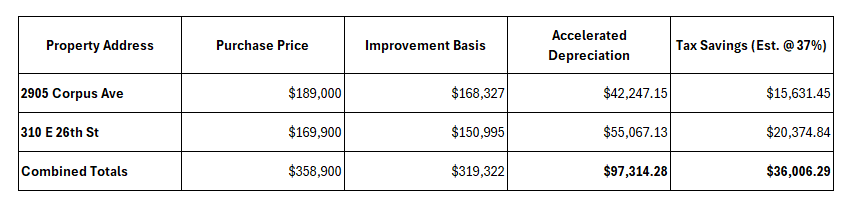

By The Numbers

Instead of sending nearly $36,000 to the IRS, Trey legally redirected those funds toward building long-term wealth.

Note on 2025 Legislation:

At the time of the study and when Trey's property was placed in service, Trey was able to claim 60% bonus depreciation on qualifying property components. This still provided significant first-year savings, but it's important to note the recent passage of 100% bonus depreciation allows Trey's total accelerated depreciation to be even higher. Now, his tax savings have exceeded $35,000 across both properties, further compounding his returns and available capital.

The Pivot: From IRS Payments to Passive Income

For years, Trey treated his IRS payments as the cost of doing business. But after discovering cost segregation, he realized those same dollars could be used to buy and improve more real estate.

These two modest SFR acquisitions opened the door to over $35,000 in tax savings—a sum that could be used for additional down payments, renovations, or even to offset passive income from other sources.

For high earners like Trey, cost segregation isn’t just a tax tool; it’s a lever for accelerated wealth.

The Outcome

With two properties and one strategy, Trey:

- Unlocked over $35,000 in first-year tax savings

- Reduced his effective tax liability across income sources

- Laid the foundation for future real estate expansion

- Diversified his portfolio without sacrificing after-tax income

Key Takeaways for Investors

- Cost Segregation isn’t only for commercial assets — it works powerfully for single-family rentals too

- Passive income earners can dramatically lower their tax burden with the right strategy

- High-net-worth individuals should explore real estate not just for returns, but for tax efficiency

Ready to Deploy Cost Seg on Your Properties?

You don’t have to become a tax expert to unlock tax-smart real estate investing. We’ll help you implement this strategy, just like we did for Trey.

Visit: SFRcostseg.com

Email: [email protected]

Phone:877-809-1390

We Unlock Hidden Tax Savings.

Cost segregation is one of the most effective, but it's also the least talked about way to reduce your tax bill.

Most CPAs don’t bring it up because they’re focused on the basics, not advanced tax strategies that maximize your savings.

This IRS-approved method reclassifies certain parts of your property to accelerate depreciation—meaning more deductions, more savings, and more cash in your pocket sooner.

Our 4-step process is proven

to save you time and money.

Request Your Free Proposal

Share a little bit of information about your property. This will help us create a personalized proposal that includes your estimated tax savings. If we need anything else, we’ll follow up with you directly.

Verify Your Property Info

After you sign, we’ll gather any supporting documents.

Don’t have an appraisal? No worries...just let our team know, and we’ll assess your property using the documents you already have.

Book Your Virtual Site Visit

If you choose our Fully Engineered service, we’ll collect more details, schedule a site visit, and give you everything needed to prepare.

No site visit is required for our Fast Reports.

Unlock Your Tax Savings

Our experienced engineers analyze your property details & prepare a custom report.

When ready, you’ll receive a final PDF along with a fixed asset schedule to share with your accountant.

Huge Tax Savings

By separating the building into its individual components, you’re able to depreciate certain parts much more quickly—over 5, 7, or 15 years.

That means instead of spreading deductions over nearly 40 years, you accelerate significant tax write-offs into the early years of ownership.

Accelerated Tax Deductions

Retroactive Tax Benefits

Increased Cash Flow

We Help Property Owners

Increase Their Cash Flow.

$250m+

Tax Savings Found

60K+

Properties Analyzed

45k+

Cost Segregations Completed

50+

5 Star Reviews

Slash Your Tax Bill by Up to 45%

© 2025 SFR COST SEG - All Rights Reserved.