How One Investor Unlocked $34,000 in Tax Savings — and Turned It into Another Property

CASE STUDY: 6609 XENIA - COST SEGREGATION IN ACTION

6609 Xenia Avenue is a newly constructed office/warehouse flex property located in Lubbock, TX. This case study highlights how the strategic use of cost segregation unlocked substantial first-year tax savings for the owner.

By accelerating depreciation on qualified components of the building, the owner was able to significantly reduce taxable income, improve cash flow, and achieve a 10:1 return on the cost of the study—all within the first year of ownership.

Explore the numbers and discover the real-world impact of proactive tax planning through cost segregation.

Prepared by: SFR Cost Seg

Client: Andrew A.

Property: 6609 Xenia Avenue, Lubbock, TX

Study Completed: 2024

Building Type: Office/Warehouse (7,200 SF)

What is Cost Segregation?

Cost segregation is a tax strategy that allows real estate owners to accelerate depreciation on certain parts of a property—such as flooring, lighting, appliances, and land improvements—by separating them from the building’s structure. Instead of depreciating everything over 27.5 or 39 years, these components can be written off in just 5, 7, or 15 years. This results in significantly larger deductions in the early years of ownership, which can lower your tax bill and free up capital to reinvest.

The Background

In 2023, investor and business owner Andrew acquired a flex space for $640,000 to support the operations of his growing construction businesses. As a values-driven leader with multiple business verticals and a desire to use real estate in his wealth building strategy, Andrew quickly discovered a powerful tax strategy that aligned with both his ethical standards and investment goals — cost segregation.

After confirming that accelerated depreciation was a legal, IRS-supported strategy, Andrew moved swiftly. In early 2024, he deployed cost segregation to complete a detailed engineering-based study, leveraging IRC §1245 and §1250 property classifications to maximize his allowable depreciation.

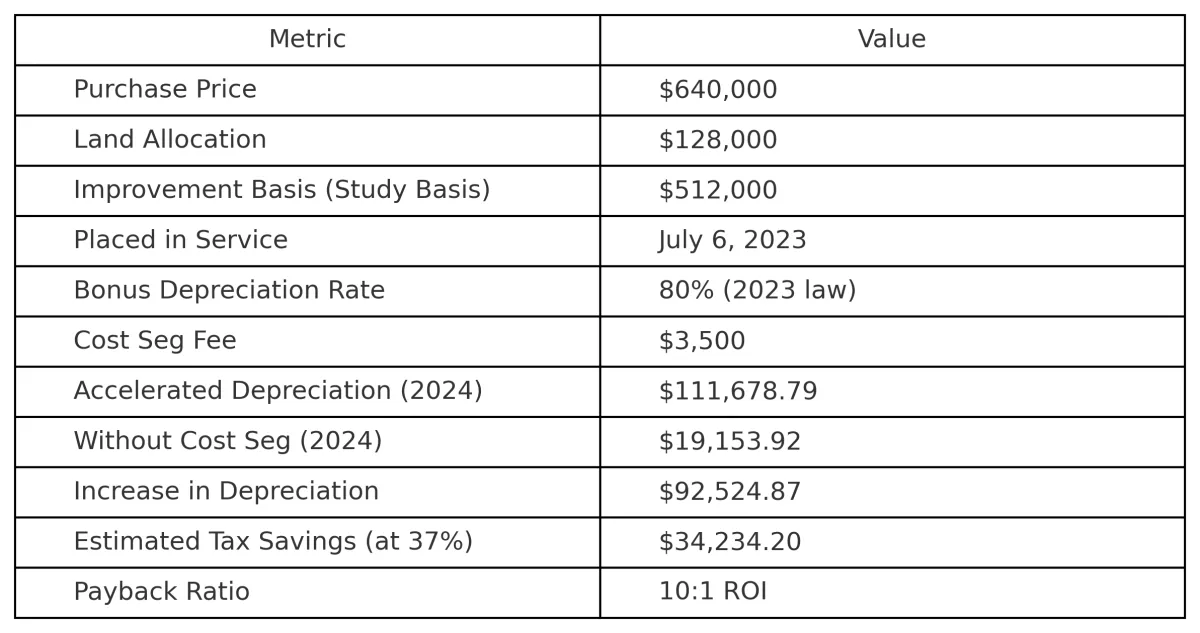

By The Numbers

The $34,234 Question: Write It Off or Build Wealth?

The $34,234.20 in tax savings Andrew unlocked through this single cost segregation study is nearly 20 percent of the cost of a typical Single-Family Rental (SFR) property in high-appreciation Midwestern markets.

That’s not just a write-off — that’s a down payment.

Instead of writing a $34,000 check to the IRS and watching it disappear, Andrew is now using that capital as a major portion of the down payment on his next income-producing rental property in 2025 — one that will generate cash flow, build equity, and grow his long-term net worth.

“This one tax strategy gave me the capital to buy another property — literally. It’s like the IRS funded my next deal.”

This is the kind of real-world leverage high earners and investors often miss — and the kind of opportunity that SFR Cost Seg exists to uncover.

The Tax Filing

Andrew elected the change in accounting method using IRS Form 3115, allowing for a clean and IRS-compliant adjustment under Section 481(a). This means:

- No amended return required

- Depreciation was properly re-captured and recorded

- Audit-proven compliance with IRS standards

The Outcome

With this single investment, Andrew:

- Recovered $34,000+ in real tax dollars in the first year

- Positioned himself to offset income from other passive investments

- Built a repeatable tax strategy for future acquisitions

- Converted tax savings into equity in his next deal

Key Takeaways for Investors

- Even small commercial and SFR properties can generate massive tax deductions

- Cost Segregation is not just for big corporations — it’s for savvy investors

- Bonus depreciation (even at 60% in 2025) still delivers serious benefits

- This is an ethical, IRS-compliant tool backed by court precedent and tax code

Ready to Unlock Your Hidden Capital?

If you own real estate — or are planning to buy — you may be sitting on tens or hundreds of thousands of dollars in hidden tax savings. We’ll help you find them.

Visit: SFRcostseg.com

Email: [email protected]

Phone:877-809-1390

We Unlock Hidden Tax Savings.

Cost segregation is one of the most effective, but it's also the least talked about way to reduce your tax bill.

Most CPAs don’t bring it up because they’re focused on the basics, not advanced tax strategies that maximize your savings.

This IRS-approved method reclassifies certain parts of your property to accelerate depreciation—meaning more deductions, more savings, and more cash in your pocket sooner.

Our 4-step process is proven

to save you time and money.

Request Your Free Proposal

Share a little bit of information about your property. This will help us create a personalized proposal that includes your estimated tax savings. If we need anything else, we’ll follow up with you directly.

Verify Your Property Info

After you sign, we’ll gather any supporting documents.

Don’t have an appraisal? No worries...just let our team know, and we’ll assess your property using the documents you already have.

Book Your Virtual Site Visit

If you choose our Fully Engineered service, we’ll collect more details, schedule a site visit, and give you everything needed to prepare.

No site visit is required for our Fast Reports.

Unlock Your Tax Savings

Our experienced engineers analyze your property details & prepare a custom report.

When ready, you’ll receive a final PDF along with a fixed asset schedule to share with your accountant.

Huge Tax Savings

By separating the building into its individual components, you’re able to depreciate certain parts much more quickly—over 5, 7, or 15 years.

That means instead of spreading deductions over nearly 40 years, you accelerate significant tax write-offs into the early years of ownership.

Accelerated Tax Deductions

Retroactive Tax Benefits

Increased Cash Flow

We Help Property Owners

Increase Their Cash Flow.

$250m+

Tax Savings Found

60K+

Properties Analyzed

45k+

Cost Segregations Completed

50+

5 Star Reviews

Slash Your Tax Bill by Up to 45%

© 2025 SFR COST SEG - All Rights Reserved.